The Cheapest International Money Transfer Fee in Canada

Send money abroad in a fast and cheaper way with EQ in Canada.

What is EQ Bank?

Equitable Bank (EQ) is a Canadian physical bank headquartered in Toronto, Ontario, with a history of more than 45 years. EQ Bank is a subsidiary of Equitable Bank, which is a federally regulated bank that manages more than $42 billion in assets. EQ is the first online bank in Canada to complete digitization.

During the non-promotional period, EQ Bank is still one of the banks with the highest interest rates in Canada.

Interest rates will change from time to time, go to the official website to check the latest deposit interest rates.

💛GOOD NEWS!

Announcing 2% interest.

EQ bank is excited to announce an increased everyday interest rate! Effective 2025, the Savings Plus Account, Joint Savings Plus Account, TFSA, RRSP, and FHSA now come with 3.00% interest. Annual interest; calculated daily, paid monthly.

I am earning 20 times more interest on my savings account compared to 0.05% on the physical savings account, thanks to EQ online bank.

Is EQ Bank safe?

Yes, EQ Bank IS SAFE.

Today, online banking is a very popular new technology financial management solution in many countries.

All your deposits in EQ Bank will be automatically protected by deposit insurance. Equitable Bank itself is a member of Canada Deposit Insurance Corporation, CDIC, so deposits in EQ Bank are absolutely safe for customer assets.

Why you shouldn't put your money in the top 5 banks?

Because you are losing money.

It is precisely because of the high operating costs of traditional physical banks that they cannot provide high-interest demand deposits to customers like online banks.

Not saying that the actual money is disappearing, but the spending power of money is disappearing with inflation.

Obviously, the same 100 dollars you have today it is not the same spending power as 10 years ago, every year becomes less valuable, it's not going to buy as much stuff year by year as inflation has been increasing a lot lately.

It's just eroding the spending power of the money that you have in savings.

Because not only super low rates but also a monthly account management fee in a physical bank.

Take CIBC Bank’s Smart Account as an example. For ordinary people to open a checking account, the bank will charge a monthly account management fee of $6.95. (Students and senior citizens have other discounts.)

This is just a basic management fee. If your transactions are more than the limit set by the bank each month, the bank will charge additional fees. If you are unwilling to pay the management fee, you must ensure that your account has at least CAD 4,000 per day.

The annual interest rate of CIBC is almost zero %. So, I would only deposit cash of around $5000 in CIBC bank to avoid bank management fees.

I would rather choose to deposit some of my short-term cash in EQ Bank because they have just raised interest rates on their everyday rate to 2.50% which is way more than I get at CIBC. Also, I can withdraw money from EQ any time I want.

EQ Saving Plus Account Pros:

EQ offers a high-interest savings account and one of the best savings interest rates available today.

- 2% High interest. (Interest rates will change from time to time.)

- Monthly interest allotment.

- No monthly fees.

- No account management fees.

- Free bill payments.

- Free Interac e-transfers

- Free EQ to EQ Transfers

- 24-hour online consultation.

- Cheap international money transfers

- No other banking nonsense

- No waiting in line at a branch

EQ Saving Plus Account Cons:

- No physical bank branch.

- Maximum balance. (maximum of $200,000 in savings plus account)

Cheapest International Money Transfers

EQ international money transfers are up to 8× cheaper than physical banks with no hidden fees.

EQ Bank customers can send money to more than 170 countries via Wise, a third-party international transfer service.

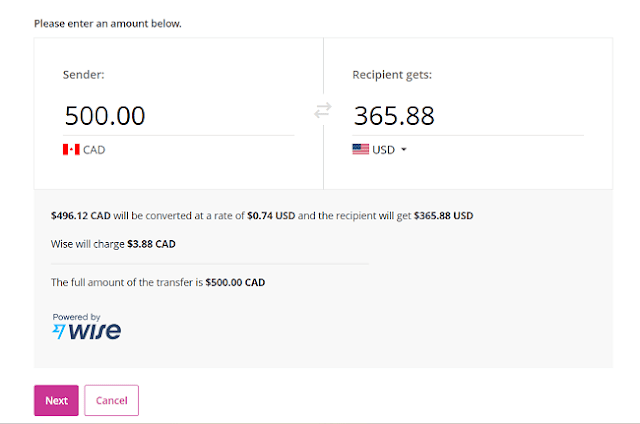

For example:

You can send money to countries around the world via EQ Bank. If you remit 500 Canadian dollars to a family member in the United States at EQ, EQ will settle the amount to you at the exchange rate of the day, without adding any hidden fees. EQ will charge $5-$6, that's all it would cost. Check out the EQ real exchange rate for yourself.

Most of the people who live in Canada should have experience with international remittances. If you transfer money through a physical bank, the handling fee is quite high.

The total cost to send USD to the United States.

- BMO Bank charges $39

- TD Bank charges $19

- CIBC Bank charges $13

- RBC Bank charges $16

EQ Debt Card

Just like a prepaid MasterCard with no annual fee.

The EQ card is a stored value debit card. The function is super practical, as follows:

- ATM withdrawals, up to $500 at a time, and up to $500 per day.

- Withdrawals from any ATM in Canada or abroad are free of charge. (When you withdraw money, you will be charged by the ATM bank you use, but EQ bank will refund you the charged fee within 10 working days.)

- Store the value on the card and get 0.5% cash back on consumption. (If your credit card rewards are not so good, you can consider using EQ Card.)

- The cash in the card also enjoys a deposit interest rate of 2% per month. For example, you deposit $800 this month, and the card balance at the end of the month is $500. The company will give you another 2.5% saving rate of CAD 12.50. So now I don't use CIBC's debit card for consumption, only for withdrawals, because I would say that I don't receive any interest at all from CIBC.

Before you open an account:

- You must be a Canadian resident.

- You must meet your province’s age of majority. (18 or 19 years old)

- Have your Social Insurance Number (SIN).

- Step 1: Apply for an EQ account for free through referral link.

- Step 2: Once you have your own account, share your own EQ referral link with people you know.

- Step 3:Your friends register for an EQ Bank account through your referral link. The more people you recommend, the more bonus you earn.

- Earned $20 for each of your first 3 successful referrals.

- Earned $40 for each of your next 4 successful referrals.

- Earned $40 for any successful referral up to the $500 maximum.

💛Another crazy GOOD NEWS!

Lock in 5% in a 1-year GIC in a non-registered account, this juicy rate makes your savings go boom.

For example, You put $10,000 in the 1-year GIC, and interest earned $500.

What is a GIC?

GIC stands for Guaranteed Investment Certificate.

GICs are one of the safest ways to invest your funds. Guaranteed rates, guaranteed returns, and guaranteed zero sleepless nights worrying about market fluctuations. In times of financial uncertainty, a guaranteed rate is a valuable feature. However, remember that EQ Bank GICs are non-redeemable, which means you don’t have access to your cash until the term is up.

Open EQ account step-by-step

How to send money from a physical bank to EQ?

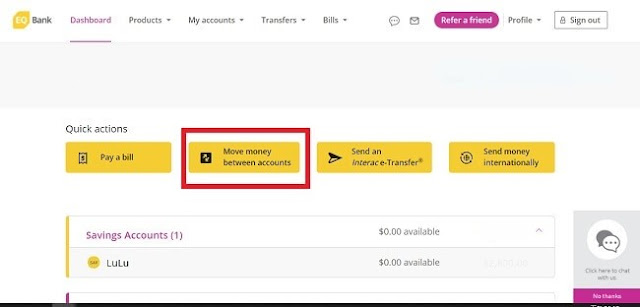

- Log in to your account, as shown in the picture above, and click the " move money between accounts" button.

- Select the physical bank you want to transfer to.

- Enter the transfer amount.

The transfer is completed in 5 minutes.

If one day, you need cash, you can transfer the cashback from the EQ to your physical bank account at any time at the same transfer method. Simple and easy.

Bottom line

EQ Bank offers very competitive interest rates, low fees, and unlimited free transfers. Great choice of an online bank.

Save More and Earn More in EQ Bank

Can you please refer me to open an account?

ReplyDeleteLock in 4.40% in a 1-year GIC, this juicy rate makes your saving go boom. ~ Awesome!

ReplyDelete